Calculate tax per paycheck

The state tax year is also 12 months but it differs from state to state. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Estimate your federal income tax withholding.

. Federal Salary Paycheck Calculator. Use the PAYucator or W-4 Check tool below and at the end of the paycheck calculator in section P163 you will see your per paycheck tax withholding amount. See how your refund take-home pay or tax due are affected by withholding amount.

To calculate Federal Income Tax withholding you will need. Calculate Federal Income Tax FIT Withholding Amount. Your average tax rate is.

If you make 55000 a year living in the region of New York USA you will be taxed 11959. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Choose Your Paycheck Tools from the Premier Resource for Businesses.

Plus you will find instructions. For example if an employee makes 25 per hour and works 40 hours per week the annual salary is 25 x 40 x 52 52000. They calculate your income by adding it up and dividing by 24 months.

Ad Ensure Accuracy Prove Compliance Prepare Quick Easy-To-Understand Financial Reports. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Important Note on the Hourly Paycheck Calculator.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Your average tax rate is. For employees withholding is the amount of federal income tax withheld from your paycheck.

Then multiply your hourly wage by the number of hours you worked to calculate your. Your household income location filing status and number of personal. Ad Payroll So Easy You Can Set It Up Run It Yourself.

All Services Backed by Tax Guarantee. The employees adjusted gross pay for the pay. Ad Get the Paycheck Tools your competitors are already using - Start Now.

How do I calculate my monthly self-employment income. That means that your net pay will be 40568 per year or 3381 per month. It can also be used to help fill steps 3 and 4 of a W-4 form.

All other pay frequency inputs are assumed to. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Some states follow the federal tax. Easily Approve Automated Matching Suggestions or Make Changes and Additions. This calculator will help to determine your paycheck amount after taxes and benefit deductions have been subtracted.

To add up your weekly paycheck first calculate your hourly wage by dividing your annual salary by 52. The amount of income tax your employer withholds from your regular pay. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. For example say year one the business. That means that your net pay will be 43041 per year or 3587 per month.

Use this tool to.

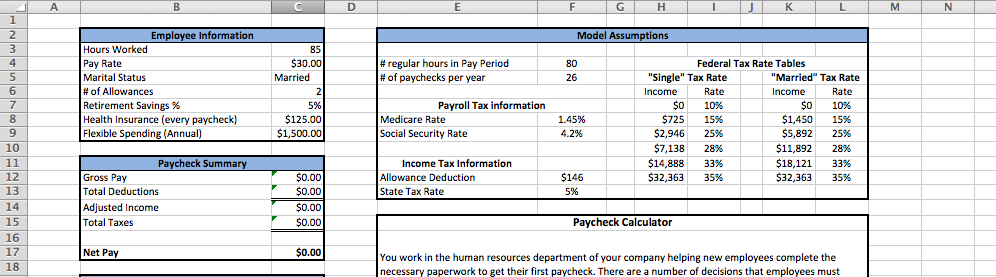

Solved Enter The Hours Worked And Pay Rate For The Employee Chegg Com

Gross Pay And Net Pay What S The Difference Paycheckcity

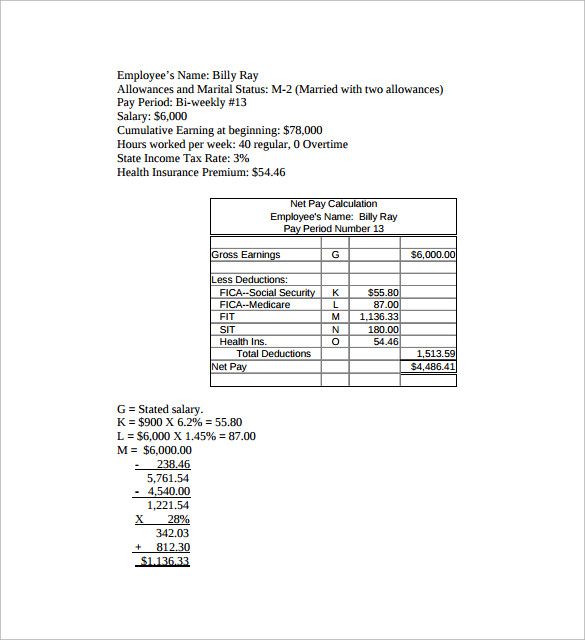

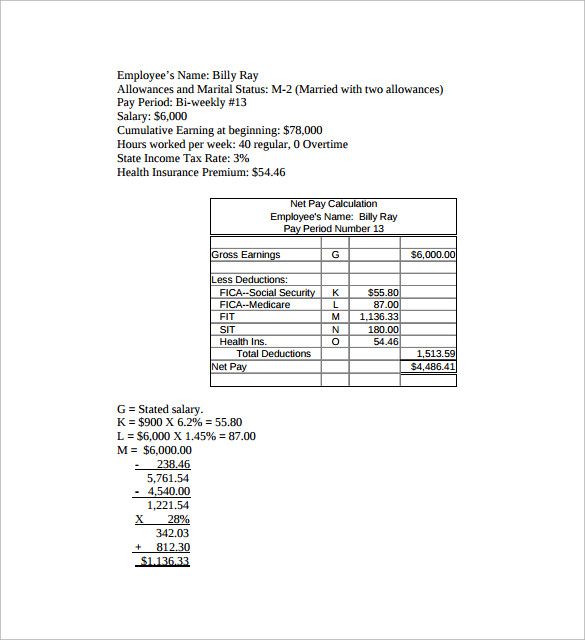

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

How To Calculate Federal Income Tax

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Salary Paycheck Calculator How Do You Calculate Your Take Home Pay Marca

Understanding Your Paycheck

Paycheck Calculator Take Home Pay Calculator

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Paycheck Calculator Online For Per Pay Period Create W 4

Ready To Use Paycheck Calculator Excel Template Msofficegeek

How To Calculate Net Pay Step By Step Example

Paycheck Calculator Take Home Pay Calculator

How To Calculate Federal Withholding Tax Youtube

Free 6 Sample Net Pay Calculator Templates In Pdf Excel